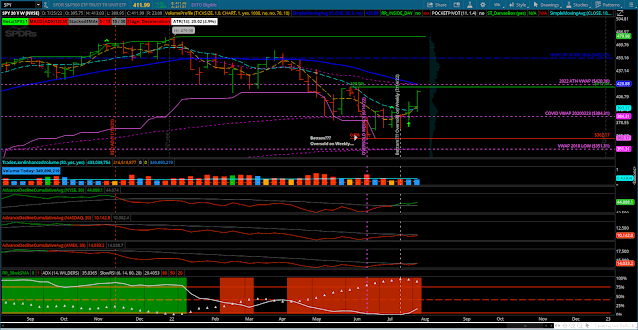

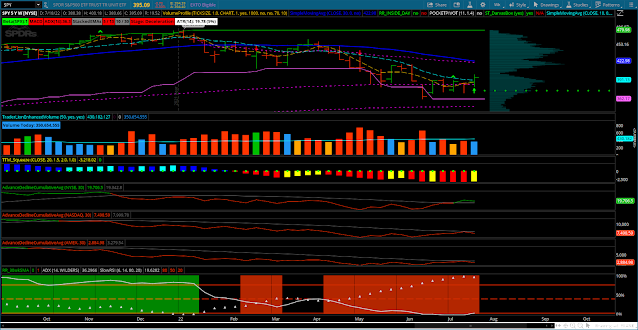

AUGUST 27, 2022

SPY skydiving after FED speak. Possible find support around $392-$385 area in prior consolidation. Switched my RISK parameters from 0.25% back to 0.125% of AUM per trade, if any new trades. Currently have a few hanging in there like HRB, NFE, LNG, ADM. Not looking to add anymore trades, just manage the ones I have for now.

SlowRSI: Turning down just below 50%.

ADX: Still dropping/slowing.

Volume: Higher than prior week but still below avg.

A/D: Red/Red/Red

Weekly Bar: Long liquidation break.

AUGUST 20, 2022

SPY pulled back just ABOVE 2022 ATH VWAP ($420.31) & 30 WEEKLY SMA ($417.35). Will the VWAP and 30weekly SMA act as support?

Volume amount is similar to prior week, but is a down week.

SlowRSI: Trending UP at the 50% line.

ADX: Dropping, so downtrend rate didn't pick up.

Volume: Below AVG, but on down week.

A/D: Green/Red/Red (switched from all green).

Weekly Bar: Closed down on below average but the range is only 2.4% compared to prior UP Week with a 4.14% range.

AUGUST 13, 2022

SPY broke ABOVE the 30 week SMA (417.88) and 2002 ATH VWAP (420.26) and above the FIB 50% retracement from ATH to Swing Low.

Volume similar to prior weeks yet a little less.

SlowRSI: Trending Up just below 50%.

ADX: Drifting lower with up movement in price.

Volume: Below AVG, similar to prior week.

A/D: Green/Green/Green.

Weekly Bar: Green Bar, Expanded Up Range compared to prior week. Closed at HIGH of the Week.

AUGUST 5, 2022

SPY just below the 30 week SMA (419.13) and 2002 ATH VWAP (420.26)

Volume a little less than prior week.

SlowRSI: Trending Up just below 50%.

ADX: Drifting lower with up movement in price.

Volume: Below AVG, similar to prior week.

A/D: Green/Red/Red but improving.

Weekly Bar: Green Bar, Smaller Range (High to Low). Closed in Upper Range.

JULY 29, 2022

The SPY seems to have found buyers around the COVID LOW VWAP ($384.31).

It is approaching the 2022 ATH VWAP ($420.36) as well as the downtrending 30 Week SMA ($420.88).

SlowRSI: Moved up, out of Oversold Area

ADX: Dropping with price uptrend

Volume: Below Avg, almost the same as prior week.

A/D: Green/Red/Red (NASDAQ & AMEX STILL RED but trending up)

Weekly Bar: Green bar closed at highs of the week.

JULY 22

SlowRSI: BARELY OVERSOLD, TREND HIGHER

ADX: COMING OFF ATH

VOLUME: BELOW AVG, SLIGHTLY LESS THAN PRIOR WEEK BUT PRICE CLOSED UP

A/D: GREEN / RED / RED (NASDAQ & AMEX BACK TO RED)

WEEKLY BAR: GREEN BAR WITH CLOSE IN UPPER RANGE

JULY 15

SlowRSI: OVERSOLD ADX: ATH

VOLUME: BELOW AVG BUT HIGHER THAN LAST WEEK A/D: GREEN/RED/RED

WEEKLY BAR: REVERSAL WITH CLOSE NEAR HIGH

JULY 8

SlowRSI: Oversold ADX: ATH Volume: Below Avg A/D: Red/Red/Red

SlowRSI: Oversold ADX: ATH Volume: Red A/D: Red/Red/Red

|

| SlowRSI: Oversold ADX: ATH Volume: Red A/D: Red/Red/Red |

SPY WEEKLY CHART SlowRSI: Oversold ADX: Near ATH Volume: Red Above Average