June 30, 2022

Thursday, June 30, 2022

Wednesday, June 29, 2022

Monday, June 27, 2022

Friday, June 24, 2022

0.18% AMZN

June 24, 2022. Stop at R/2 for 0.18%.

June 24, 2022. Higher Low. Entry: $114.62 Sold Half at R1: $115.47 Moved stop to R/2: $114.20

1.08% NVDA

June 27, 2022 Stopped out for 1.08% Gain.

June 24, 2022. Higher Low. Entry: $166.49 Stop: $163.00 R1: $169.98 (sold half) and moved stop to R/2: $164.75

0.24% TSLA

June 24, 2022 Higher Low Small Position Entry: $730.54 Sold Half at R1. Move Stop to R/2. Stop out at R/2 for small 0.24%

Thursday, June 23, 2022

Friday, June 17, 2022

-4.91% HQY

June 23, 2022. Stopped Out. -4.91% Loss

June 17, 2022 Weinstein Scan. Entry: $69.41 Stop: $66.05 R1: $72.77 R/2: $67.73

30min squeeze with volume.

Thursday, June 16, 2022

7.78% GO

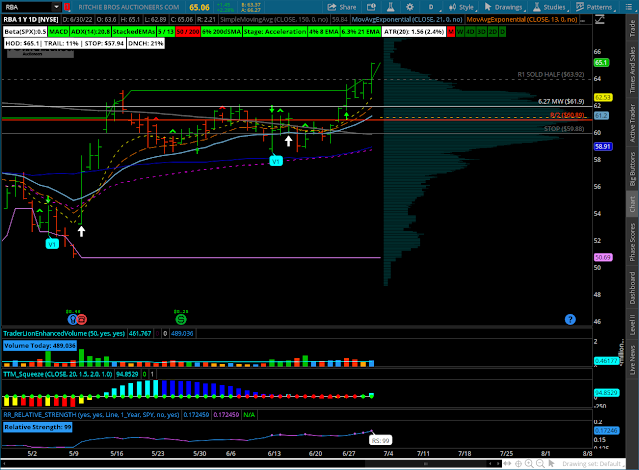

JULY 27, 2022

STOPPED OUT ON LAST PORTION, SHOULD HAVE HELD FOR EOD STOP AND NOT A HARD STOP. WILL WAIT AND SEE IF IT SETS BACK UP AROUND $46.13

July 23, 2022 SOLD A PORTION AT BREAK OF 13DEMA

July 15, 2022

June 16, 2022. Volume Profile.

June 16, 2022. R1 hit, sold half for 2.46% profit. Moved stop to R/2: $19.29 then transition to 11% trail stop.

June 16, 2022. Entry: $38.57. Hourly squeeze with one dot daily sqz. Quarterly sales increase.

Wednesday, June 15, 2022

-6.52% TWI

June 16, 2022. Stopped out: $18.35 gap down. -6.52% loss.

June 15, 2022. TWI $19.63 10min Chart with stop at LOD.

Thursday, June 9, 2022

-5.92% ARIS

June 10, 2022. Stop Hit $20.51 for -5.92% loss

June 9, 2022. Inside Week. Entry: $21.80 R1: $23.00 Stop: $20.60 (1 atr)

-4.59% BP

June 10, 2022. Gapped Down. Stop: $32.44 -4.59% loss

June 9, 2022 ENTRY: $34.00 STOP: $33.28 R1: $34.72 R/2: $33.64

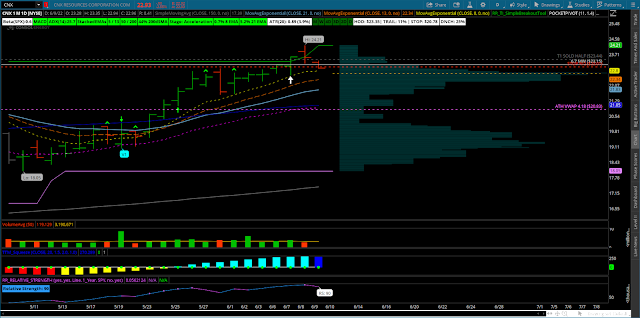

WEEKLY SQZ FIRED AND APPROACHING NEW HIGHS.

Weekly Chart:

0.91% GPRK

June 9, 2022: Stop at R/2: $17.17 for 0.91% gain.

June 8, 2022: Sold Half at T1: $18.49. Moved stop to R/2: $17.26

June 7, 2022. ENTRY: $17.67 STOP: $16.85 R1: $18.49

0.31% CNX

June 9, 2022. R/2 Hit: $23.01 CLOSED FOR SMALL GAIN. 0.31%

6.7 SOLD HALF AT $23.44, Didn't like the thin volume profile. Moved stop to R/2: $23.01. Now have other half for a runner.

6.7 ENTRY: $23.15 STOP: $22.49 T1: $23.81

Wednesday, June 8, 2022

-6.68% ATI

June 08, 2022. STOPPED OUT AT $26.69 for a full loss. Too big of a % loss.

DAILY SQZ. BREAK ABOVE VWAP FROM PRIOR HIGH.

-3.43% ADI

June 9, 2022. Stopped out. $161.70

June 6, 2022 ENTRY: $167.45 STOP: $161.70 T:$173.20

WEEKLY SQZ AND BASE

Tuesday, June 7, 2022

-2.36% SO

June 9, 2022. Stop hit for small loss $73.90. -2.36%

6.7 ENTRY: $75.69 STOP: $73.90 ACCIDENTAL BUY, MEANT TO BUY SSO :) AT LEAST IT WAS SMALL STARTER. WILL TRAIL STOP ONLY. Start with initial stop then transition to 11% emergency trail stop.

Wednesday, June 1, 2022

0.97% ATGE

June 10, 2022. Stopped Out: $32.24 small winner +0.97%

ENTRY: $32.92 SOLD HALF T1: $34.24 MOVED STOP UP (R1/2): $32.26